Interview with Abdelmadjid Fechkeur, CEO, RedMed Group, Algeria

What can hard work, determination, and perseverance get you? For twin brothers Abdelmadjid and Riad Fechkeur, the answer is: nothing less than perhaps the most successful entrepreneurial venture in the recent history of Algerian free enterprise.

Since taking the first steps as the RedMed Group in 1996, the company has developed into a well-oiled machine offering integrated services and logistical support to the exploration, production (EPC) contractors involved in the energy sector in Algeria.

What began as two brothers selling mineral water to oilfield workers has grown into a corporation with a market cap of $35 million, more than $200 million in revenue, and 3000 employees throughout 20 affiliate companies.

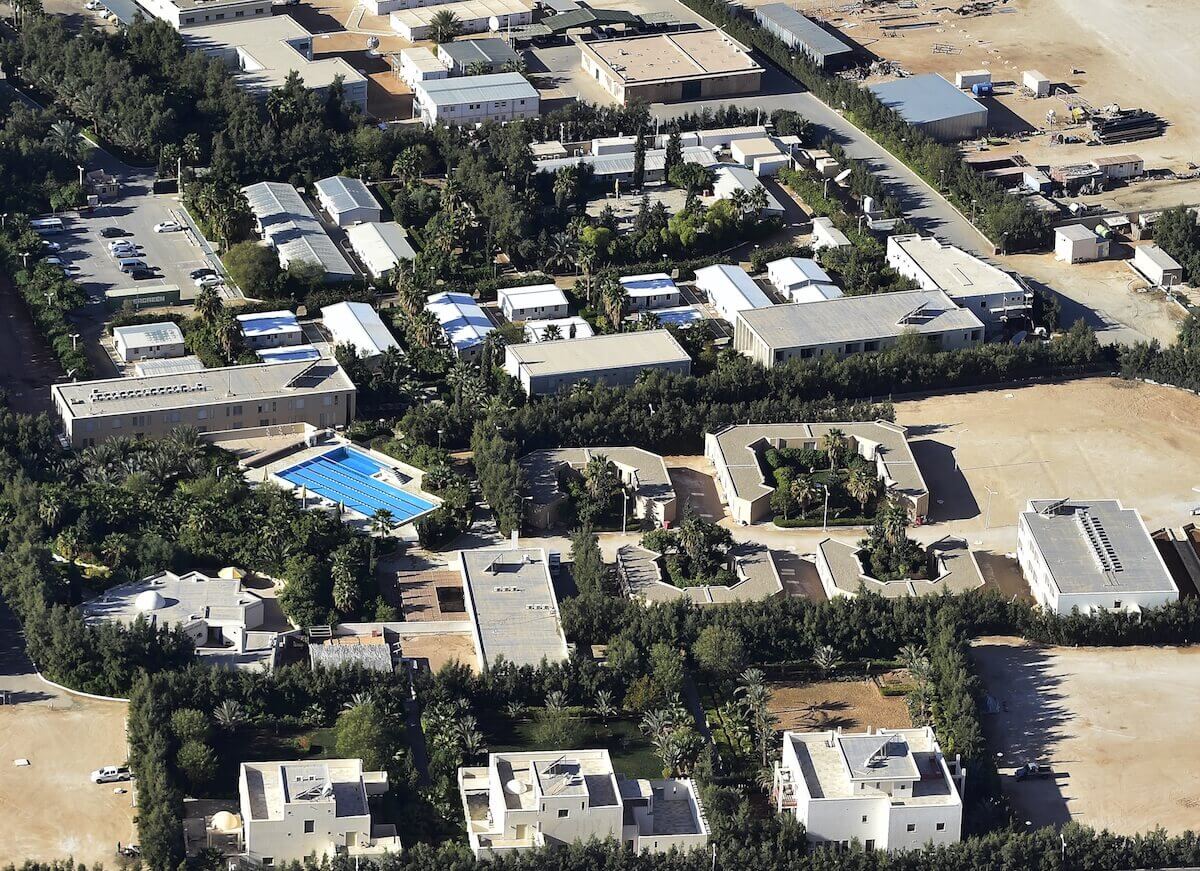

RedMed’s core business is in the provision of office space, accommodation, storage yards and workshops to the oil and gas companies primarily operating in southern Algeria, with permanent bases located in Hassi Messaoud, Adrar and In Amenas. Of course, this barely scratches the surface of this extensive family business.

Now with 20 affiliate companies, RedMed has expanded its scope and interests into other industries, most notably aviation, medical support, HR services, training, lifting and ground transportation, civil works, and environmental sciences with further intentions to diversify.

Tharawat Magazine spoke with Abdelmadjid Fechkeur to discuss The RedMed Group’s humble beginnings, boom period, and how they plan to handle issues of succession and family governance.

Algeria does not have a long history of free enterprise so you wouldn’t have had many entrepreneurial role models growing up. How did you discover your entrepreneurial spirit?

My brother Riad and I studied business and finance in Algiers between 1989 and 1993. After that, I decided to go to Paris to complete my studies to gain experience outside of Algeria, because at that time, the country was still considered as a socialist country and its economy unique. Having completed studies in Algiers and then Paris, by 1995, we had a decision to make whether to apply for a conventional job in banking or oil and gas industry perhaps, or to take an entrepreneurial route. So we decided to create a small company to provide support to the oil and gas companies operating in Algeria. At this point, we did not yet have a business model – but we recognised that the companies needed support and assistance. Our first project was to provide bottled water to an American company, Bechtel, who was, at that time, building a pipeline. At that point, it was just Riad and myself who were running our first project. We completed everything by ourselves– all the administration, accounting, paying suppliers – and we were yet to find office space.

When did you see the first stages of growth? What brought it about?

Not long after becoming operational, British Petroleum entered the Algerian market and BP became our first large contract. They were looking for somebody who could speak English, who could be interpreters and who could help them procure small things like stationary and supplies. Between Bechtel and BP contracts, we started to get some cash flow in, and from there we could hire some drivers. With some people responsible for the deliveries, we were up to five or six employees including my brother and I.

What kind of learning curve did you go through at this time?

For us, working with BP was educational because they are a huge corporation, with high standards and attention to detail. We learned a lot, and we passed on what we knew to our employees afterwards. It was a win-win situation. BP was pleased to deal with us because we handled many of the time-consuming headaches for them. Things like hiring locals, arranging catering, finding chefs and drivers, renting cars and all those things that international companies find difficult to achieve without local knowledge. After a few years with BP, we decided to build a permanent base and to start our own operations in Algeria. The client needed a base with full life support, which meant everything from accommodation, to catering, laundry services etc. We built a base with 18 bedrooms, kitchen, restaurant, and offices. All of it as a result of what we learned through our contract working with BP.

Was it at this point when things started to take off for you?

This was not the big boom period for us yet. That would come few years later, but we were certainly growing quickly. After the first year, we expanded the base to 58 rooms. We started to grow the business through joint venture partnerships with other companies. Sterling Group was a great example of this. During that period, it was difficult to do business in the region because of the security situation. The owner of the security company came to see my brother and I and suggested we entered into a joint venture, explaining that they wanted to provide their service to BP. That was in 1999, and all these years later, the same person is now the Chief Operating Officer of our group.

A joint venture partnership is how we initially got into the aviation industry. There was a Swiss company that had a few airplanes, and they were clients of our base. We wanted to set up an air taxi service in Algeria and everyone thought we were crazy. But I saw that they had 25 or 30 years of experience in maintenance and aviation, and while I didn’t have any of that, I did have the local knowledge. When we got the air operator’s certificate (AOC) in November 2001, I went to the ex-managing director of the Algeria Airlines and said ‘Can you help me do this?’ He came on board, and that is how we became shareholders in Star Aviation. Of course, all the aircraft were registered with the Swiss company, but then we had to register aircraft in Algeria because that was part of the AOC. Eventually, we bought out the Swiss partner and left him with a minimum number of shares.

You mentioned a “boom period” for your company? When did this occur?

I would say the boom started in about 2005. We had expanded into medical services, training, logistics, ground transportation and lifting equipment. We were just starting booming. At one point during this time, we have been approached by the International Finance Corporation (IFC), World Bank Group. They were looking at investing in Algerian private sector. So we said yes, agreeing that they should do their due diligence on the Group. They were intending to possibly invest $10 million. During this process, we learned something very important; for most of our existence, it was just my brother and I in a limited liability company. Not long before, we decided to set up a formal governance structure with a board of directors that now includes our younger brother and our sister. Therefore, when the IFC came and did their due diligence, we found out how important governance and transparency is. When they came with their checklist, it gave us a real insight as to what they value and what they look for. Governance and transparency are crucially important to financial institutions looking to back you.

Did you get the investment from the IFC?

That’s a funny story. While this was ongoing, we brought in KPMG and said ‘Can you please do an audit of our company? Look at our finances, look at our financial statements and tell us how we can implement better governance.

The first thing they did was to convert our statements into US dollars: so we could compare our standing against the international standard. They helped us and showed us we had a good cash flow, and overall, an excellent financial situation. We were close to signing with the IFC but then at the last minute we decided to refuse their loan. People asked us why many times! Well first, we had the opportunity to borrow from local banks and stay independent. And we really wanted to stay independent which an agreement with the IFC would not have permitted. We could get $5 million from the local Algerian bank for seven years, at a great interest rate. The choice was obvious, but we learnt from the IFC’s due diligence process, which was very helpful in the years moving forward.

You and your brother did the opposite of many entrepreneurs in your situation. Many of them left to pursue opportunities elsewhere while you stayed to build a business in your home country. From the time you started, how has the business environment evolved around you?

It certainly has evolved throughout the years. I think we were lucky starting off; we were the first and only company to offer support services in oil and gas. It is not a very big niche. We are not dealing with the whole 40 million population of Algeria. We are dealing with ten big corporations, and we gave them all the logistical support: food catering, accommodation, offices, training, aviation, logistics, camps, medical staff, all of that. Our father was in oil and gas before us so it made sense that we would start there. It was our natural environment. Algeria is not the easiest country to do business in. It is virgin territory in a lot of ways. It was easier 20 or 30 years ago than it is today because there were no rules back then. But for us, we always look ahead; we never look back. Today we have $200 million in revenue, and that is where we stand today, with 3000 employees and 20 affiliate companies.

[ms-protect-content id=”4069,4129″]

Looking ahead then, what do the next few years have in store for The RedMed Group?

We are now expanding into real estate by building the tallest building in Algeria. It will be 11 stories – which is the maximum number of stories we are allowed to construct. It will have 15,000 m² office space and restaurants. We are also constructing a meat processing plant. We are just starting with the factory, and are already thinking of how to export the meat. We are currently in contact with Spanish and French companies to work up to their standards and to be able to work with them very closely. We are also diversifying in healthcare. We are talking to potential investors to develop more clinics all over Algeria. The pace of development is much faster now. We have to do in five years what we previously did in twenty years. The opportunities cannot wait. Algeria is changing; it is opening up. The other challenge is setting up the Group for transition in the future.

Is the general intention for you to keep it inside the family so that your children will ultimately join?

To be honest, these are the question marks today. We were not expecting that our business would ever be what it is today. Now the business has grown, and this poses problems, but they are good problems to have. And for these good problems, it’s difficult to find a solution in Algeria. Why? Because the history of entrepreneurs in Algeria is only twenty-five years old. There are no companies that have been around for 100 years. They do not exist, so we have to look at Canada, the Middle East, and Europe to see how these companies achieved success.

I know you spoke about your plans for the immediate future but if you could take a broad look into the future, what is your greatest wish for the RedMed Group in the years to come?

I would say business diversification, growth, and also geographic diversification. These are the things that are very important to us to move forward. We would like to operate across the region, not just in Algeria. I am confident we will find a good balance going forward and will continue to spot the right opportunities for our family and business.

[/ms-protect-content]