Photo by Florencia Potter from Pexels

Latin America holds great diversity socially and economically. Entering such a vast new market holds many opportunities but also many challenges. Edward Nicholson, Managing Partner at Mercator Partnership Limited, and Consultant to Maitland Group, offers insights to businesses looking to establish a presence in Latin America for the first time and considers two distinct phases in the process – Planning and Implementation.

Fortunately for today’s investors there is a wealth of information available that they can exploit before setting foot on the American continent. The challenge consists in how to filter this information to answer three key questions: what business, where and how? Addressing each of these is critical if a competitive and sustainable business platform is to be established.

Planning: Homework Does Matter

Time taken to plan the approach to Latin America carefully is time well spent given the region’s diversity and rapidly evolving economic and political landscape. It is a region with significant growth potential and the building of strong foundations at the outset will bring rewards later.

Having a clear vision of why one is entering the market gives focus to the research. This vision will be specific to each investor and may range from simple geographic expansion (same business new market) to full diversification (new business new market) but may also contemplate other considerations such as access to low-cost production, diversification of political risk, or access to scarce resources (mining/ agriculture). The answers to the ‘What business’ question should become clear once the objectives and rationale for entering the market have been evaluated.

One mistake that is often made by foreign companies entering Latin America, and especially Brazil, is that the vision for the business needs to be commensurate with the scale of the market. There are numerous examples of businesses, which have entered on a sub-scale basis, underperformed (because they are not relevant in their sector) and have then been forced to withdraw because their boards lost patience.

The following are illustrative of some recent investment flows and demonstrate the various approaches to deal structures:

• Minority stake in a listed business: The Qatar Investment Authority made a sizeable investment ($2.7bn) in Banco Santander, Brazil, in which the Botin family from Spain is a significant shareholder.

• Controlling stake in a private business: At the other end of the scale, the UK Group, G4S, made a 51% investment in a Brazilian Group, Plantech Engenheria, a security systems integrator, with the option to increase its stake over time.

• Controlling stake in a business from a German Group and other shareholders: The Indian Group, India United Phosphorus Ltd recently acquired 51% of DVA Agro do Brasil, an agro-chemicals producer, for US$150mn.

• Acquisition of 100% of a private business: GSK‘S acquisition of Laboratorios Phoenix, an Argentine pharmaceutical business for $253mn.

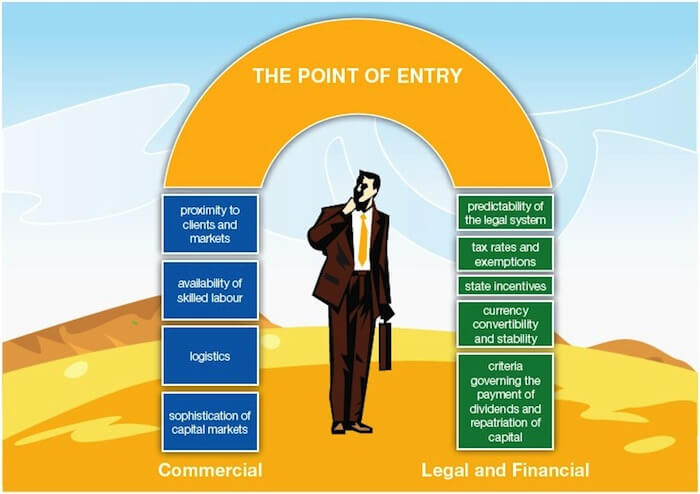

The point of entry (country and/or city) may be determined by the nature of the business activity to be undertaken particularly if this relates to natural resources, the need for a port or a scarcity of potential business targets. If not, the choice of location may be determined with the help of two filters:

• Commercial – considering factors such as proximity to clients and markets, logistics, availability of skilled labour and the sophistication of the capital markets. While English is widely spoken in business, it is not universal, and therefore knowledge of Spanish or Portuguese (Brazil) would be an advantage. Access to education for expatriate staff can be critical.

• Legal and Financial – including predictability of the legal system, tax rates and exemptions, state incentives, currency convertibility and stability as well as the criteria governing the payment of dividends and repatriation of capital. Regulatory considerations will also be important if entering a regulated industry – typically these include public services such as energy and water or strategic industries such as air-transport, newspapers and broadcasting and recently agriculture (in some countries) as will as healthcare or banking. Foreign demand for farmland has prompted a review of ownership criteria in Brazil and Argentina.

In practice, while the choice of location will often be determined by one or two key considerations specific to the business, the issues raised above still need to be considered.

Implementation: Concentrate on the Objectives and their Feasibility

Sizeable “Greenfield” investments are comparatively few and are usually subject to special criteria. The focus will therefore be on acquisitions and alliances relating to existing businesses or small start-ups.

The use of quality professional advisors is essential for legal (structuring, contracts and due diligence) and taxation issues and the use of a specialist intermediary (bank, broker or consultant) for an acquisition or alliance can add real value – they may have better information on and access to potential targets, particularly when sounding out a target’s interest. They can also be useful at key points in the negotiations by acting as a filter.

In Latin America, personal relationships are valued highly and therefore getting to know your partner and/or target is a good investment. Business families like to cooperate with other families and like to deal on a principal–to-principal basis.

Experience has shown that it is invariably beneficial to have at least one well-connected local person involved with the business on an ongoing basis. This can help avoid and resolve potential issues with officialdom – and there will be some!

The implementation process is substantially similar to that in any developed market but it is worth commenting on:

• Target identification: Where this is not obvious, as in the case of a competitor, use an advisor to source or validate potential targets.

• Price: Reaching agreement on price may require patience – optimism on prices is standard. Consider using a formula to future performance to bridge any material gaps.

• Due Diligence: Use the best available lawyers, accountants and industry professionals and build a comprehensive knowledge base on any family, which may become a partner – if they are well known this should not be difficult.

• Governance: Be sure that the governance structure post acquisition or in an alliance really works and has sufficient redundancy in it to operate as intended. If taking a minority stake, ensure that there are enforceable exit provisions giving fair value.

Lastly, be prepared to walk away if the price becomes uneconomic or if there are substantive questions, which are not being answered.

Alliances and Joint Ventures: Possibly an Excellent Method of Market Entry

Many companies initially enter the Latin American market through an alliance or joint venture, which can have a number of advantages for both parties. One should note, however, that the majority of alliances end within seven years with one party acquiring the other. Understanding the relative value added by each party and how this might change over time is critical. Strategic alliances and joint ventures can be complicated and considerable care is required with their structuring and documentation. It may be helpful to look at these in terms of their commercial rationale – the contributions of the parties and need for IP protections and their legal, financial and operational provisions – such as governance, exit and value sharing arrangements.

Latin America is a region potentially offering excellent rewards for those with a carefully considered strategy and who embrace its challenges.

Tharawat Magazine, Issue 13, 2012