Image source: Rafael Guajardo

Latin America still remains relatively unknown to most people, a legacy of the years of military and authoritarian rule, hyper-inflation and the sovereign credit problems of the 1970’s and 1980’s. This was a time when the region was effectively isolated from mainstream world activity, a situation not helped by poor communication and long distances. Since then the change has been dramatic. Politics are democratic, several dynamic economies have evolved (Brazil, Mexico, Chile and more recently Peru) creating strong foundations for future regional growth, opportunity is abundant, and social mobility is creating a new consumer class. Family-owned businesses have been and will continue to be at the forefront of this development. This article by Edward Nicholson, Managing Partner at Mercator Partnership Limited, and Consultant to Maitland Group, provides an introduction to the region, examines the importance of family businesses within the overall economic framework and concludes with a perspective on the future.

Historical Context

Discovered and colonised initially by the Spanish and then the Portuguese, more than 500 years ago, it is only since the turn of the last century, that the Latin American region really began to evolve into what it is today. The societies we know today were formed in a process catalysed by successive waves of migration from Western, Central and Eastern Europe, the Middle East, and Japan and by immigrants who brought essential skills and the drive to build a new future. The presence of Arabic names such as Haddad, Maluf, Mahfuz and Moffarej, serve as a reminder of this, as does the more than one million second and third generation Japanese in Sao Paulo, Brazil.

The Relevance of Latin America in the Modern Global Economy

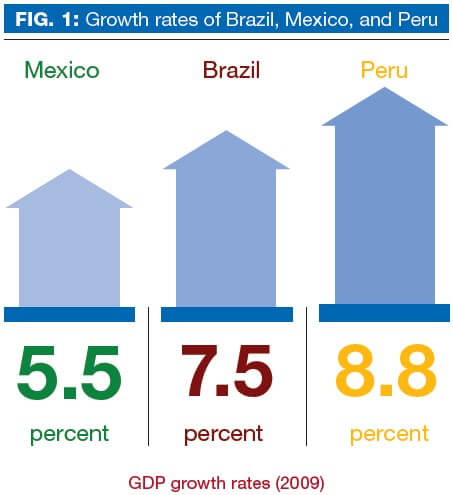

As a major provider of strategic commodities (iron ore, copper, zinc, beef, wheat and soya), an important market for manufactured and increasingly luxury goods, and with Brazil an aspiring permanent member of the UN Security Council, Latin America has acquired a significance that seemed unlikely 30 years ago. Its location, establishes it as a natural trading partner with Asia and its economies are growing fast – GDP growth rates of 7.5% and 5.5 % in Brazil and Mexico and 8.8% in Peru (2009) (See Figure 1, left). The region has produced some major global companies in recent times including Vale, Petrobras, Gerdau and AB Inbev – a trend which looks likely to continue.

Natural Resources – A Core Competence

Minerals and agriculture have long been dominant themes. Recent discoveries of additional oil and gas reserves will greatly reduce dependence on traditional suppliers and provide a massive economic stimulus, particularly in Brazil.

The region has been a major beneficiary of the demand for copper and iron ore, of which it has some of the largest reserves in the world, from China, India and Korea and for beef and other agricultural products in part due to the “protein chase” from emerging economies.

Manufacturing and Retailing Highly Relevant and Growing…

Latin America is a major manufacturing hub and has growing importance in retail and is also increasingly a supplier of services. Ford, Toyota, VW, General Motors and Renault amongst others manufacture cars in the region while Rio de Janeiro is the support centre for offshore oil exploration. The size and growth potential of the regional market has encouraged global brands such as Nestle, Unilever and Kraft to develop significant local production facilities encouraged by low labour costs. While not privately controlled, Embraer, the maker of short/medium-haul aircraft now sells its aircraft worldwide and enjoys an excellent reputation for quality. The region is also a leader in financial services having been scarcely impacted by the credit crunch of 2008. Banks like Itau Unibanco and BTG Pactual, both privately controlled, have built strong franchises in retail/commercial and investment banking respectively.

The Impact of Changing Demographics on the Demand for Consumer Products

Economic growth has led to the creation of a sizeable and growing middle class with increasing levels of disposable income driving demand in the consumer, durable and food products sectors. In the case of Brazil the A/B economic groupings now represent nearly 50% of the population. Some years ago the CEO of a major multinational was asked why he was so positive about being in Brazil. He replied “where else can you go in the world to add 9 million new customers for our products every year for the foreseeable future – that’s the market size of Portugal…”.

Marketing to the C, D, and E socio-economic groups requires a different approach and manufacturers and retailers alike have become adept at producing products targeted to this segment and at offering financing to consumers to enable them to buy products, which they would otherwise be unable to afford. This is illustrative of the wealth of creativity that exists to overcome challenges and consistent with the can-do attitude found in many Latin American markets.

Avoid Generalisations on Latin America…

Understanding the region is important but understanding the specifics of the country with which you are dealing is critical because the key factors impacting decisions may be very individual and imply different risk profiles. Foreign investment has primarily focused on Brazil, Mexico, and Chile although Peru has also received considerable mining investment. For the new entrant to the region, Brazil, Chile, and Mexico have usually been the first markets with which people like to get acquainted.

Family Controlled Businesses – The Engine of Growth in Latin America

Family controlled businesses have been the driver of growth and employment in Latin America. With the exception of a handful of state controlled champions such as Codelco in Chile, Petrobras in Brazil or PDVSA in Venezuela as well as the Pension Funds in Chile and Peru, the majority of economic activity is seeded and controlled by private family-owned companies or foreign multinationals, often in partnership with local companies. There are, however, few businesses, which can trace their family ownership back more than three generations with the majority of businesses still in the founder or second generation.

The map (See Figure 2 above) shows examples of entrepreneurial families, which have built sizeable enterprises. In Mexico these include, Carlos Slim, considered the world’s richest man, who controls a conglomerate including telecoms (Telmex and America Movil), retail (Sanborns), and industrial holdings. In Brazil, the Egydio de Souza Aranha and Morreira Salles families have a controlling position in Itau Unibanco, the region’s most successful bank, and the Emirio de Moraes family control the Votorantim Group with interests including basic materials, mining, pulp and paper. In Chile, the Luksic family has extensive interests including mining (Antofagasta) banking and shipping and in Peru, the Romero family control Banco de Credito, the county’s major bank. The family names of Diniz, Cisneros, and Perez Companc are all readily identifiable with prominent businesses in their home countries, Brazil, Venezuela, and Argentina.

A Distinctive Growth Model for Family Businesses

There are two characteristics that define family businesses in Latin America: The first is that the businesses typically consist of multi-business portfolios with investments in several activities, often with no synergies between them. The second is that the strategy adopted by many families consciously includes the introduction of external capital to accelerate growth historically because debt markets are underdeveloped and interest rates can be prohibitively high. The risk of loss of control is less than in many other countries because different classes of shares can be used making it possible to retain control with a shareholding as low as 17%. In a region where debt markets are limited, the ability to raise additional equity to dilute below the normal 50% level, without losing control, provides added flexibility to owners to maintain their competitive position in a rapidly growing market. Lack of capital can be a constraint for those companies opting to remain fully private although the use of strategic joint ventures can mitigate this where access to specialist capabilities is required.

The introduction of external capital to Latin American family businesses has greatly improved “governance and transparency” with benefits for family and shareholders.

Extra-regional Growth – The Development of an International Footprint

Only 10 years ago it was unusual for a Latin American company to have an international presence. Since then, a number of regional champions have internationalised their businesses in a series of well-planned opportunistic moves. The evolution of the Gerdau and Bimbo Groups illustrate this (see Figure 3 below).

Challenges Faced by Business Families

The challenges that business owners have to confront, is influenced by the countries in which they operate but common to all are the following:

• How to sustain growth to remain competitive in a rapidly changing environment and balance this with the financial needs of the family shareholders. The issues here being the retention of control, the debate over re-investment versus higher dividends, and the level of additional risk to be assumed.

• The role the family should have in the business whereby the main challenge is to recognise the need to professionalise management

• How to attract and retain the best talent in a competitive labour market.

For a small minority, how to mitigate the impact of political risk can also be of major concern. This may consist of excessively onerous taxes or constraints on the export of capital to the other extreme of expropriation. Fortunately, the latter is rare in Latin America but it does demonstrate the need for geographic diversification to lower risk. Interestingly, families impacted by this often tend to believe that things will improve with time – a state of denial likely to end up in destroying significant value.

Within the “family” dimension, family governance is a constant topic of discussion including pressure to diversify portfolio risk and increase dividend levels. Another subject widely debated concerns the treatment of share ownership in case of generational change or marriage. Families develop their own policies for this depending on the specific circumstances but there have been a few well-publicised cases where rifts and conflicts have been exposed. This usually originates in the failure to define the ground rules at an earlier time, when this would have been less controversial, or reliance on goodwill in the family, which may be absent in the subsequent generation. Fortunately, advance planning and harmony are the norm.

Looking to the Future

With the expectation of continued strong demand for commodities and the further growth of the middle class with higher disposable income, the regional growth story is positive with forecast GDP growth rates in excess of 5%. The World Cup (2014) and the Olympic Games (2016), to be held in Brazil, will undoubtedly create a legacy of major infrastructure improvements including construction of major roads, airports and transport generally. While these aspects have been neglected until now, there is the capability to do projects on a major scale.

Inadequate infrastructure still remains a constraint in many Latin American countries and governments need to address this urgently if they are to encourage the growth essential to facilitate much needed investment in the needs of society and particularly education and health.

The growth in oil exploration and production provides a further cause for optimism, which could prove to be game changing in the case of Brazil. However, even discounting this, there are many positives to focus on as well as opportunities for business families and investors from outside of the region to participate in the next chapter of Latin American growth.

Tharawat Magazine, Issue 12, 2011