Innovation, the constant renewal of products, processes, and business models, is crucial for the long-term success of any company. Joseph Schumpeter, one of the pioneers of modern management and strategy, spoke in the early 20th century about “creative destruction” as an ongoing trend in any industry: New innovations replace former ones and force established firms to undergo the painful yet necessary process of adaptation in order to survive in the long run. Dr. Nadine Kammerlander, Researcher at the Family Business Centre of the University of St. Gallen, Switzerland, paints an intriguing picture of the precarious balance between the advantages and challenges of family ownership and management when addressing innovation and change management.

The long way from invention to innovation

Being innovative does not only relate to launching a large number of new and promising products. Innovation is comprised of tapping into more efficient ways of processing materials, using new technologies for development and production, convincing potential customers to use the offered goods in a different setting and/or coming up with creative and sophisticated distribution channels and business models.

Not every invention is destined for innovation. One of the managing directors of the large, high tech family business group Freudenberg recently stated: “For one successful product innovation, we statistically need to process more than 400 ideas.” Successful firms typically have installed institutionalised and sophisticated processes to scan the environment for upcoming trends, to familiarise themselves with technologies and product features and to develop and evaluate the new products on their way to commercialisation. Depending on the industry, firms typically spend up to 15% of their revenues on research and development activities. These companies are characterised as “innovative” if a significant portion of their revenue is generated by products launched within the past three years.

Innovation in Family Firms

In general, opinions on how innovative family firms operate largely diverge. Many family-owned “hidden champions” are known for their state of the art products and product quality. Many experts trace this innovativeness back to the family firms’ long-term focus. For instance, the US-based family business W.L. Gore launches innovative outdoor clothing products on a regular basis and thereby defends its market leadership. In the German automotive industry, family-owned car manufacturers Volkswagen, Audi, and BMW are known for their continuous technical innovations, with particular focus on efficiency, safety, and comfort.

Conversely, family influence in firms is often associated with stability, conservatism, and tradition; attributes that are known to inhibit change in general and innovation in particular. This notion is confirmed by several empirical studies, which left researchers with the conclusion that family firms typically spend less money on research and development activities as compared to their non-family influenced counterparts.

How can this seemingly paradoxical picture of innovativeness in family firms be explained? A recent research study took a look into the black box of family firm innovativeness and revealed the strengths and weaknesses attributable to family ownership.

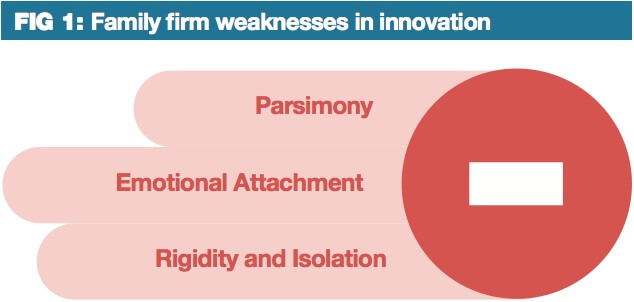

Family firm weaknesses in innovation

Family firms are different from non-family firms because of their specific structure and governance, their particular goals, their stock of available resources, and also their history. Those differences lead to several disadvantages typical to the impediment of innovations in family firms (Figure 1):

Parsimony. The first of a few challenges for family firms lies in financing the development of innovative products. Product development often requires highly skilled and experienced employees and expensive high tech equipment. Depending on the industry, periods of development often reach 10 years or more, hence the development of a single product requires large investments with no guarantee of returns. While many family firms, particularly those with wealthy owners, have the principal ability to finance innovative activities, many of them are not willing to do so. Owners are often reluctant to take on additional debt, investors, or other external financing measures because they fear the dilution of control over their firms.

Emotional Attachment. Family firms often place their focus on tradition and history. This has two important consequences that can both diminish innovativeness. First, glorification of past successes might induce owners and managers to overlook the need for further change – a phenomenon often labeled as “myopia”. This happened, for instance, to the renowned and previously very successful German model railroad manufacturer Märklin which ultimately had to file bankruptcy in 2009. Second, launching innovative products, processes and business models often means withdrawing focus from long standing activities. For instance, the emergence of mp3 files entailed the instantaneous decline of CD sales. Family firm owners and managers have typically built up high emotional attachment to their products, which makes them reluctant to replace them.

Rigidity and Isolation. Another source of disadvantage for family firms lies in their often observed inflexibility stemming from routine rigidity and homogeneity of employees’ skills. Inflexibility can lead to overlooking important upcoming trends and to developing products that are insufficiently innovative. Such inflexibility in family firms is mainly triggered by the long employment durations of managers and employees. This occurs particularly when family firms routinely hire people with similar educational backgrounds and those employees form a “closed group”. Such workplace uniformity creates a low probability for the introduction of innovative ideas and even less so “radical” advances. This becomes an even larger problem for family firms that are unwilling to involve any outside input, e.g., from consultants or industry experts, when making decisions.

Family firm advantages in innovation

Is family ownership and/or management always detrimental to innovativeness? The answer is a clear no. Despite certain challenges, family firms also possess several strong assets, which act in favour of innovation upon which they can build (Figure 2):

Long Term Focus and Patient Capital. Family firms are often characterised as possessing long-term planning perspectives. When they invest they think in years and decades, rather than in months and quarters. Experts call this the competitive advantage of “patient capital”. Patient capital allows family firms to invest money in complex new product developments that require years before being commercialised. An example of this is the family firm dominated German car manufacturing industry. Firms started to invest in the development of electric cars decades ago and first models have now been on sale for years. However, while the development effort is huge, no one can predict if and when demand will finally take off.

Decision-Making Principles. One of the major competitive advantages that family firms can build on is their manner of decision-making. How family firms make decisions is often characterised by the involvement of only a few people and is often based on intuitive reasoning rather than on sophisticated and detailed business plans and calculations. While such organisational behaviour is often criticised as inefficient and risky in stable environments, it proves highly beneficial when so called radical innovations threaten the market. In such times, listed companies are often impeded by having to wait for reliable facts and figures to be available and included in their calculations. Family firms, however, are often free to quickly decide and react. Moreover, the high levels of legitimacy and power of family firm CEOs often make it easier to push the changes through the organisation and avoid any political resistance amongst managers or the ad-hoc re-allocation of resources.

Experience and Commitment of Loyal Employees. Although long employment tenures can entail inflexibility, they can also be turned into an important competitive advantage for family firms. This is particularly the case for so called “continuous” innovations that constitute important improvements based on previously developed products. Examples of those innovations could include, for instance, increasing the horsepower of combustion engines or making household appliances more energy-efficient. In such situations, family firms can build on the tacit knowledge of their experienced, long-term employees. If the family has succeeded in constructing a positive “family firm identity” with a feeling of belonging and shared goals, they can rely particularly on their loyal employees. Those employees will proactively seek opportunities for innovation and bring them into the firm.

Implications

The influence of the family factor represents a double-edged sword for an organisation’s innovativeness. Family ownership and management entails several weaknesses but also advantages. To fully exploit opportunities, family firms need to mitigate their weaknesses as much as possible.

Family firms should develop investment and cooperation strategies in order to grant sufficient resources and external influence. A first step to this objective is full transparency applied to the firm’s R&D spending, particularly as compared to competitors, and on how these investments are tied to the aspired mid- and long-term goals of the company. Next, partnering with other family firms facing the same challenges regarding innovation might help overcome the “parsimony” barrier as investment and risk is diversified across several partners. Informal exchange and more formal cooperation and joint ventures with start-ups are likewise beneficial in gaining access to complementary skills and knowledge. Moreover, such contacts also help employees to remain open-minded to innovations and avoid dangerous “tunnel vision” amongst decision-makers.

To further avoid the trap of rigidity, personnel managers should pay attention to pursuing a diversity of skills and backgrounds in recruitment. In addition, individual development plans and continuous training and education for employees and managers in the R&D department might help to keep a constant inflow of relevant information on ongoing trends and development.

Family firm decision-makers need to sufficiently detach themselves from products and technologies that are likely to play only subordinate roles in the future market. From a psychological standpoint, this is not an easy task, particularly for long-term and committed managers and owners that have built up a large stock of psychological ownership in the past. Yet, it is a wise choice to generate the awareness among all decision-makers in the firm that only by replacing old processes, products, and business models with new ones, does it become possible to remain competitive in the long run.

In addition to the above mentioned activities aimed at alleviating their disadvantages, family firms should also build on their strengths and make use of them. Characteristic decision-making principles and leveraging long-term planning horizons allow those firms to make quick decisions in uncertain environments, implement them without substantial internal resistance and stick to them over a long period of time.

Furthermore, by building up a strong and positive family firm identity, those firms can strengthen their competitive advantage. Family firm identity enhances the employees’ sense of belonging to the company and increases their loyalty and commitment. Several mechanisms, such as an emphasis on the shared history, active involvement of the employees in current developments (e.g. by transparent and proactive communication), and gestures that reveal appraisal of the employees (e.g. celebration of successful projects or owners that take a personal interest in employees) can help to build up such an identity over time.

Put differently, family firms are likely to be most successful in their innovative behaviour if they find a sophisticated way to balance the family firm characteristics standing for stability and tradition with an entrepreneurial behaviour that leads them to seek and exploit future opportunities. Finding the synergies between those two focal points prepares family firms to master the challenges of innovation and change management for the better.

Tharawat Magazine, Issue 17, 2013