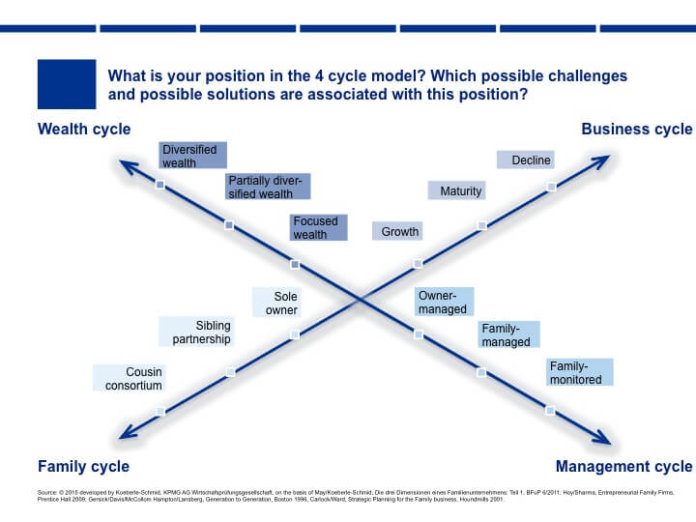

When you undergo the family wealth diagnosis, you will be able to find out where your family business is in the wealth cycle. By understanding where your family enterprise stands, you cannot only identify the challenges of today and tomorrow, but also help the family chart its path to greater success.

You have successfully diagnosed your family business in the wealth cycle. Where are you in the matrix below?

The logic behind the wealth cycle is risk diversification. This can be done in two ways: One is by investing besides the firm in different assets (e. g. stocks, bonds, fund, PE, art, real estate, etc.) through the help of a family office and building-up family wealth. The second way is to build up or buy different firms with a different product and service offering (e. g. food, banking, hotel, etc.) and increasing your business wealth. If a family goes either way, it will be partially diversified. If it goes both ways in parallel, it will be completely diversified, which increases complexity.

To find out more about the 4 Cycle Model and what it can do for your family business, click here.

The information contained herein (also the challenges and possible solutions derived after the quiz) is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.