Editorial by François de Visscher

We live in a VUCA world—volatile, uncertain, complex and ambiguous. What lessons have been learned during the 2020s, to help owning families grow wealth for current and future generations, amidst the turbulence ahead?

The COVID-19 pandemic is but one example of the many interconnected forces that are disrupting the world today (e.g., environmental, technological, globalization, socio-politico-economic). They are dramatically changing the economic landscape for business families around the world, and the pace of change is accelerating.

Global Forces of Change and Disruption

With continued instability ahead, families need a playbook to weather future shocks and position themselves to be strong and flourish. Multigenerational families who play the long game know that setbacks—large and small—are inevitable, and get ready for them. But the turbulence in our current era will occur at a velocity that even the most experienced families are unpracticed at withstanding.

The new playbook for family wealth takes a total family wealth perspective, and offers a three-part formula for managing wealth in turbulent times. Putting these strategies in place will be a key determinant of families’ ability to regenerate their wealth and success for decades to come.

A Total Family Wealth Perspective

A critical first step is for owners to view their wealth from the right vantage point. Two key changes in perspective will be required: (1) gaining altitude to comprehensively view—as a portfolio—all of your family’s wealth, and (2) understanding how wealth travels through your family enterprise.

Your Total Family Wealth Portfolio

Family wealth can refer to many different kinds of value, viewed and managed as a portfolio of assets that, collectively, make up your total family wealth.

Asset Categories in A Family’s Total Wealth Portfolio

A family’s values, culture, talent and reputation are at the heart of its wealth portfolio, anchoring and driving the family’s pursuit of wealth for current and future generations. The family’s total wealth encompasses its entire portfolio of assets, which includes intangible assets (e.g., know-how) as well as economic wealth.

Your family’s economic wealth includes all of your jointly-owned financial assets, which can be divided into five broad categories:

- Operating businesses and investments, such as legacy businesses, other operating companies, direct investing, and intellectual property

- Liquid assets and investments, including cash, investment portfolio, funds and hedge funds, and alternatives (e.g., crypto)

- Real estate investments, including commercial, retail and residential real estate, as well as investments in land

- Socially responsible investments, such as impact investing, social ventures, and strategic philanthropy

- Tangible family assets, including homes, aircraft and other lifestyle investments, heirlooms, art, and collectibles

In today’s world, owners must take a more active, comprehensive, and integrated approach to their wealth. The focus should be on managing not just a particular business or asset, independently from the others, but on long-term total wealth. This requires that families transition from “business managers” (with an operator mindset) to “wealth managers” (with an owner mindset).

Wealth Inflows and Outflows

Owners need to understand how wealth travels through and impacts the growth of their entire portfolio of assets.

Wealth is not static, so understanding and managing the top and bottom lines of the equation for your family’s total wealth is essential. On the top line, you need to know how assets are growing across all categories. Return on capital, reinvestment, smart bets, diversification, and market value appreciation all are factors.

Understanding (and managing) the family’s wealth also requires attention to how assets are being depleted by activities such as dividends, family lifestyle consumption, and philanthropy as well as bad bets, cost of debt, ownership buyouts, taxes, inflation, and estate planning for the entire portfolio of assets.

With this high altitude, portfolio perspective and a solid understanding of how wealth travels through the family enterprise, owners are ready to put in place the strategies needed to grow multigenerational wealth in turbulent times.

The SGA Formula for Managing Wealth

Stability and growth have long been the hallmarks of multigenerational family wealth. “Don’t rock the boat” and “Stay hungry” are messages often heard in enterprising families. In today’s turbulent times, stability and growth remain vital to success, and agility is the critical added ingredient.

Families that want to successfully navigate changing times and build wealth through generations use this three-part formula for managing their total wealth: Stability, Growth and Agility (SGA).

Stability: The Foundation

The SGA Formula for Managing Total Family Wealth

The ability to withstand shocks is the bedrock of a strong wealth strategy. A strong financial foundation is perhaps the most obvious requirement, and includes the availability of liquidity (cash) to honor commitments and a conservative balance sheet (low debt). Family businesses are celebrated for their strong balance sheets, generally an indication of their superior performance in any sector.

Ownership stability also is fundamental. United and engaged owners with a long-term commitment to the future of the family and the family enterprise are essential. And—linking the two—is a well-oiled governance system with a focus on strategic (versus operational) issues, efficient decision-making processes, and effective mechanisms for coordinating family and owner interests with business and investment interests.

Growth: The Engine

Profitable, sustainable growth is the engine that allows your total family wealth to be transmitted to future generations. Developing a long-term growth strategy will involve studying megatrends in the sector(s) where you are operating, and doing deep-dive opportunity and risk assessments across all asset categories in your wealth portfolio.

Long-term growth requires the careful balancing of asset growth, liquidity, and ownership control over time, combined with sustainable consumption and careful management of risk-reward tradeoffs. Spreading risk is an important aspect of wealth growth, and can be achieved through external partnerships, mergers and acquisitions, minority stakes in some investments, and diversification.

Diversification as a Growth Strategy

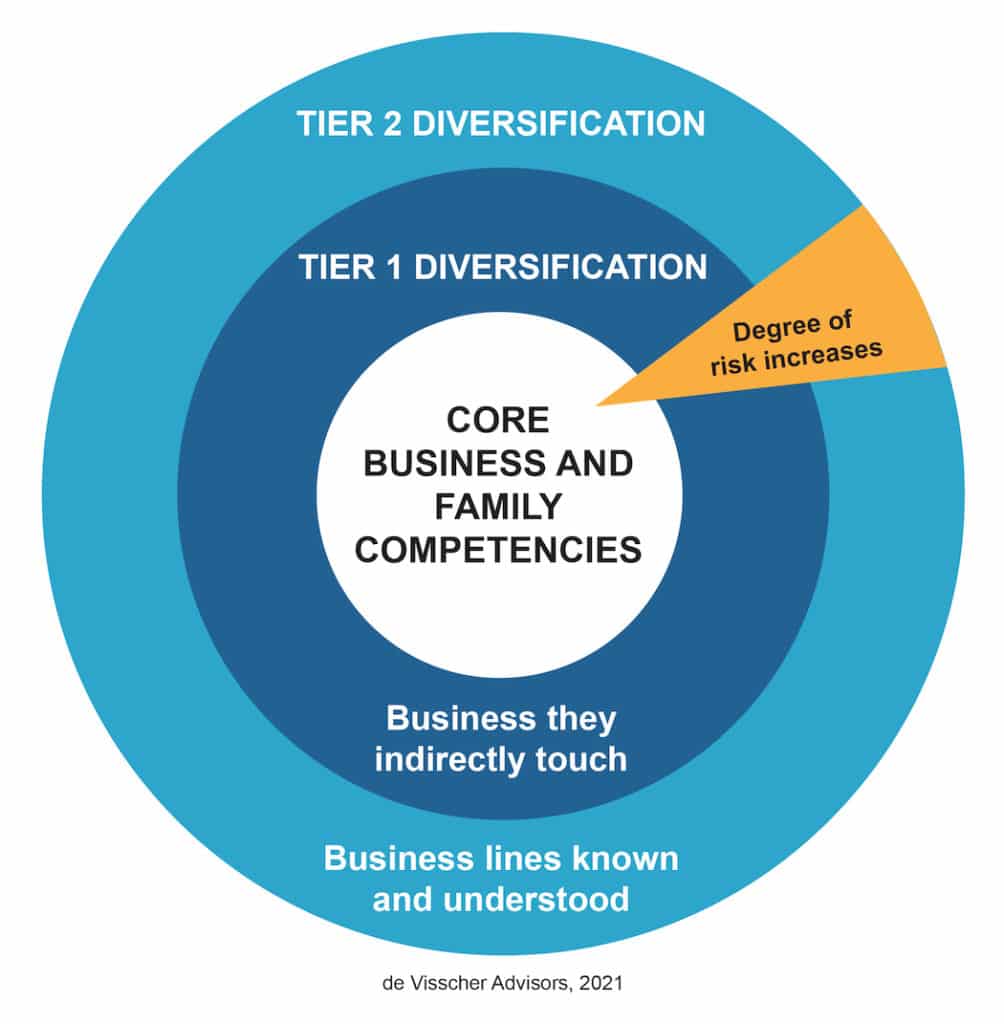

Diversification is a good way to spread risk and gain access to capital, know-how, and experience. It is not without risk itself, however, so compatible diversification is the safest route. That approach involves diversifying along the family’s core competencies (i.e., knowledge, capabilities and resources that distinguish you from others). The further into the unknown you go (i.e., Tier 2 diversification), the greater the risk.

Tiers of Diversification and Risk

Growing a Multigenerational Portfolio

A total wealth portfolio with elements that address the interests and risk profiles of each generation (e.g., impact investing for younger members, lower risk for senior members) supports both asset diversification and differing family needs. Family members can partner across generations to gradually architect a “generation-adjusted portfolio” that engages and motivates each generation, in pursuit of their long-term family mission and goals.

Agility: The Adaptor

With the amount of rapid change occurring in the world today, no portfolio, organization, or ownership group will succeed without agility—the ability to pivot and reinvent. Constantly scanning the horizon for signals of change and being prepared to quickly adapt to new realities are critical, to survive and thrive in an ever-shifting landscape.

For a family wealth portfolio, agility is the ability of owners and managers to move financial and human resources quickly to address threats and seize opportunities. Its key aspects are speed, decisiveness, preparedness, flexibility, and the ability to pivot to new models or strategies and, as necessary, detach from a particular investment, business, or way of doing things.

An owning family must exercise agility on multiple dimensions. Capital flexibility (e.g., different types and structures of capital for new investments), ownership flexibility (e.g., different ownership structures, some minority stakes, openness to new partners), and decision-making flexibility (e.g., fast and effective governance) all are essential, to build agile portfolios and organizations.

The Change Imperative

Agility requires an openness to new ideas and a willingness to let go of old methods and forge a new path. Reinvention and transformation are hallmarks of success for today’s enterprising families, which can be a challenge for owners who define stewardship as clinging to the status quo rather than looking for opportunities to build value according to their values, in each generation.

Not everything has to change—and not all at once—but families need to recognize that what has worked for growing their family’s business and wealth in the past is not likely to keep working for much longer, and moving slowly (or not at all) will come at a cost. Failure to keep up means being left behind.

François de Visscher is the President of de Visscher Advisors, Co-founder and Executive Chairman of FODIS, and a Senior Advisor and Associate Partner at the Cambridge Family Enterprise Group.

*Cambridge Institute for Family Enterprise is the research and education division of Cambridge Family Enterprise Group.